Bitcoin Funding Rates Surge 20% On Major Exchanges — What’s Happening?

Bitcoin prices have rebounded this week from last week, forming a Consecutive record highs Over the past 7 days. The big question on everyone’s mind over the past few days is – when will the top cryptocurrency break the $100,000 level?

While most investors are worried about short-term goals, some market participants are more worried about the long-term prospects of the world’s largest cryptocurrency. According to the latest on-chain data, it looks like Bitcoin’s price may be on course for a shakeout sooner than expected.

Will rising bullish sentiment sustain the rally?

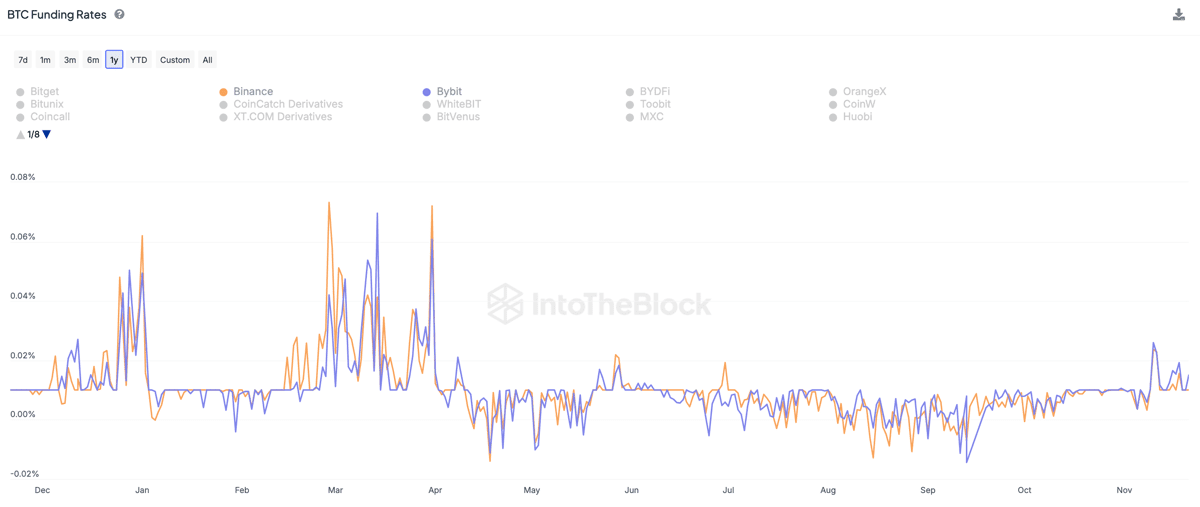

market intelligence platform Enter the neighborhoodBitcoin funding rates have increased significantly in recent days. The relevant indicator here is the Funding Rate indicator, which tracks the periodic fees exchanged between traders in the derivatives (perpetual futures) market.

When funding rates are high or positive, it means long traders are paying short traders. Typically, this direction in periodic payments indicates strong bullish sentiment in the market.

On the other hand, a negative funding rate indicator means that investors holding short positions are paying traders who took long positions in the derivatives market. This trend indicates that the market is gripped by bearish sentiment.

Data from IntoTheBlock shows that Bitcoin financing fees for perpetual contracts have increased by more than 10%, and by as much as 20% on major trading platforms. However, the on-chain firm noted that continued increases in funding rates could signal overheated speculation, potentially leading to a market correction.

According to IntoTheBlock, one of the possible catalysts for this bullish sentiment is the US government’s attitude towards cryptocurrencies under Donald Trump. A “strategic Bitcoin reserve” is more likely under the incoming US president, with investors pinning their hopes on Bitcoin’s valuation exceeding six figures.

At the time of writing, the flagship cryptocurrency is worth around $98,400, up 1% in the past 24 hours.

Bitcoin Perpetual Futures Market Still Restricted – What It Means

In a recent article on the X Platform, Glassnode disclose Bitcoin perpetual futures market “remains constrained.” This shows that even though Bitcoin prices have climbed steadily in recent weeks, some traders are still cautious about entering the market.

Data from Glassnode shows that the Bitcoin financing rate is slightly above 0.01%, which is lower than the level in March 2024 when the BTC price reached a local top (about 0.07%). Ultimately, this shows that there is still room for growth in the value of the major cryptocurrency.