Ethereum On-Chain Demand Should Sustain ETH Above $4,000, IntoTheBlock Says

Market intelligence platform IntoTheBlock reveals how Ethereum built a strong on-chain demand zone, keeping it above $4,000.

Ethereum has two major support centers just below current price

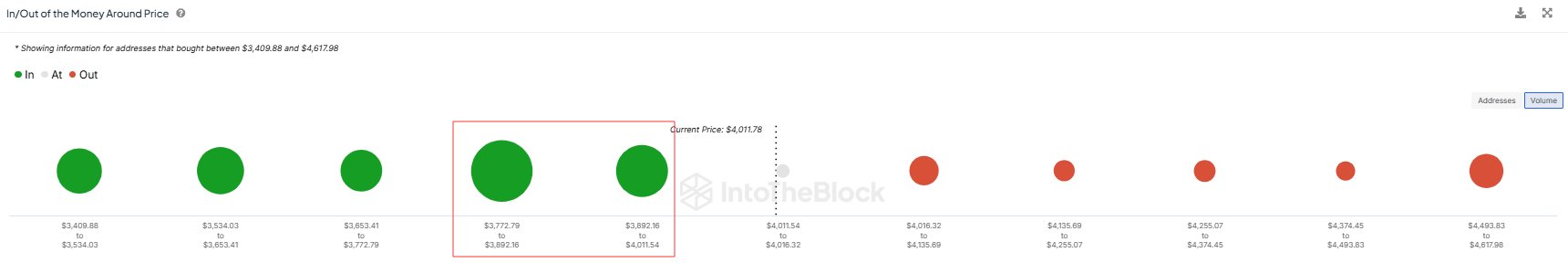

in a new postal At X, IntoTheBlock discusses the current situation in Ethereum’s on-chain demand area. Below is a chart shared by the analyst firm showing how much supply investors purchased in a price range close to the current ETH spot value.

As you can see from the chart, Ethereum’s previous price range only had a few small dots associated with it, meaning there wasn’t a lot of supply bought at these levels in the end.

However, the situation is different for the following price ranges, the $3,772 to $3,892 and $3,892 to $4,011 ranges are particularly cost-based for hosting a large number of addresses. Investors purchased a total of 7.2 million ETH at this level (worth nearly $28.4 billion at current exchange rates).

Related reading

Demand zones are considered important On-chain analysis Because of how investor psychology tends to work. For any holder, their cost basis is an important level so they are more likely to take action when it is retested.

When this retest occurs from above (i.e. investors have been profitable before this), holders may decide to buy more, thinking that the level will be profitable again in the near future. Likewise, investors who lost money before a retest may fear another decline, so they may sell at breakeven.

Of course, when only a few investors participate in buying and selling, these effects are not important to the market, but when a large number of holders participate, significant fluctuations can occur.

The above price ranges fulfill this condition, so Ethereum retesting them could generate a sizeable buying reaction in the market, ultimately providing support for the cryptocurrency.

Ethereum has seen a slight decline in this area over the past day, so it remains to be seen whether high demand will push Ethereum back above $4,000.

Related reading

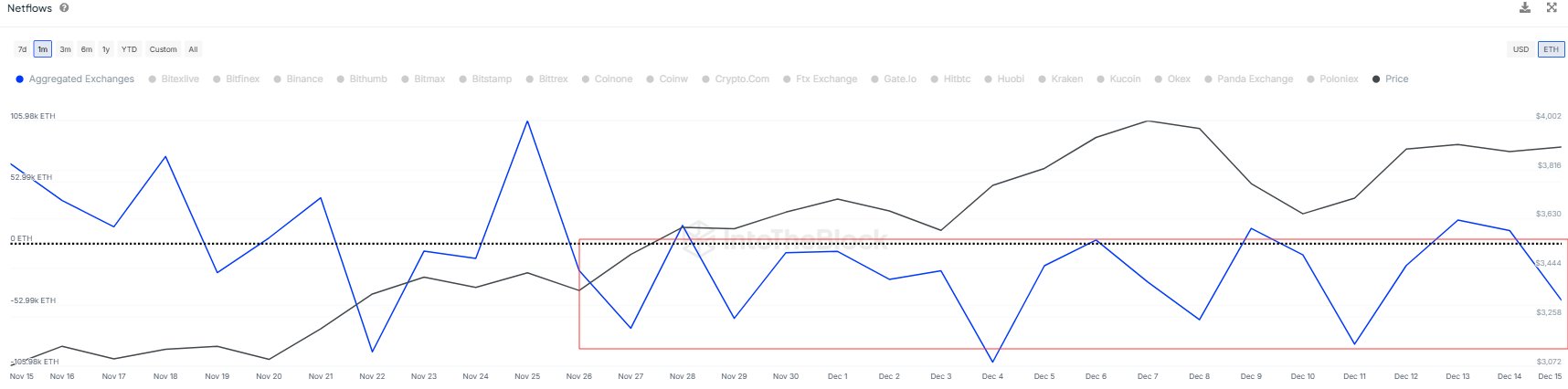

In some other news, Ethereum exchange network traffic As IntoTheBlock pointed out in another X, it has been negative since the beginning of the month postal.

Exchange Net Flow is an on-chain metric that tracks the net amount of Ethereum flowing in or out of wallets associated with centralized exchanges. “More than 400,000 ETH have flowed out since December 1, indicating an accumulation trend,” the analytics firm noted.

Ethereum price

As of this writing, Ethereum is trading at around $3,950, up 10% from last week.

Featured images from Dall-E, IntoTheBlock.com, charts from TradingView.com